« BACK TO BLOG

Market Intel, Forecasts & Strategies

NAIOP CRE Sentiment Index 2025 Signals Renewed Optimism in Commercial Real Estate

Understanding where commercial real estate is headed requires more than looking backward—it means tracking sentiment, capital flows, and on-the-ground activity across the industry. On a recent episode of America’s Commercial Real Estate Show, host and Commercial broker Michael Bull, CCIM sat down with Marc Selvitelli, President and CEO of NAIOP, to unpack the NAIOP CRE Sentiment Index 2025 and what it reveals about the future of the market.

The takeaway? After years of uncertainty, commercial real estate sentiment is rebounding in a meaningful way.

What Is the NAIOP CRE Sentiment Index?

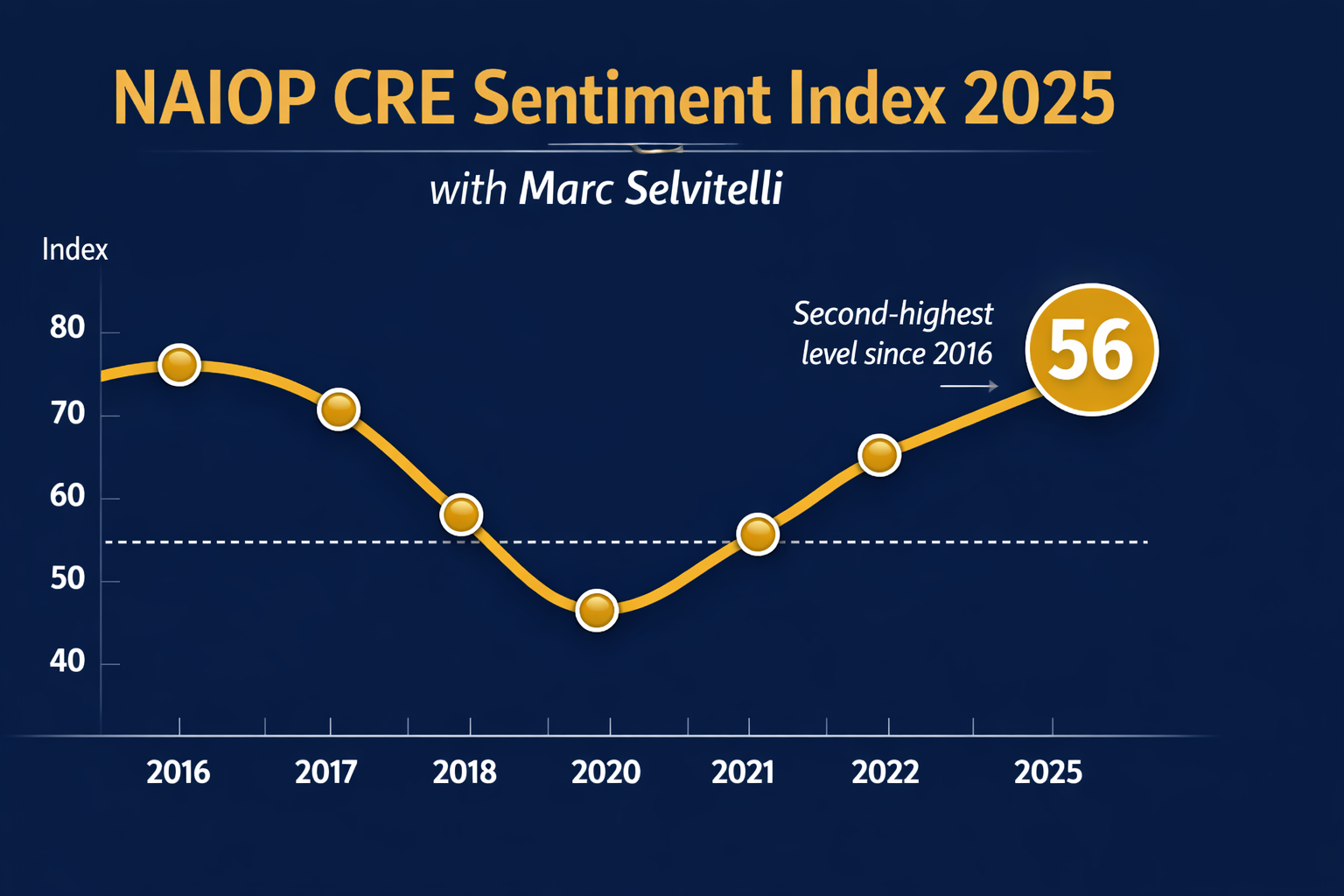

The NAIOP CRE Sentiment Index is a biannual survey launched in 2016 that captures outlooks from developers and non-developers across commercial real estate. With nearly a decade of historical data, the index has become a reliable barometer for where the industry is heading.

The index is scored from 0 to 100, with 50 representing neutral sentiment.

2025 Sentiment Index Results: A Strong Rebound

In the latest release, the NAIOP CRE Sentiment Index came in at 56, marking:

- The second-highest level since the index began

- A six-point increase from the prior survey

- One of the largest jumps outside of the post-pandemic rebound

Just six months earlier, sentiment sat at a neutral 50. Compared to the low 40s recorded during the depths of the pandemic, the improvement is striking.

According to Selvitelli, this shift reflects a sharp reduction in uncertainty across capital markets, development conditions, and public policy.

Interest Rates and Capital Markets Drive Optimism

One of the biggest contributors to the positive outlook is confidence in capital market conditions.

Survey respondents cited several encouraging trends:

- Multiple Federal Reserve rate cuts, each at 25 basis points

- Expectations that additional cuts may continue into early 2026

- Growing belief that cap rates have peaked and may begin declining

- Significant capital that has remained on the sidelines now preparing to reenter the market

As Selvitelli noted, when capital becomes cheaper and more predictable, transactions and development activity follow.

Occupancy, Rents, and Sector-Specific Trends

Industrial

Industrial remains a bright spot, even after a temporary rise in vacancy due to post-pandemic oversupply. With development starts slowing, the market is moving back toward equilibrium, and vacancy rates are expected to decline.

Office

Office continues to face challenges—but stabilization is emerging:

- Class A and trophy office space is performing well, with low vacancy

- Class B and C buildings remain the primary drag on overall office metrics

- Adaptive reuse and office-to-residential conversions are helping absorb obsolete inventory

NAIOP’s upcoming office demand forecast shows a promising sign: nearly 20 million square feet of positive net absorption in Q3, the strongest quarter for office since 2022.

Construction Costs, Materials, and Labor Outlook Improves

Earlier in the year, uncertainty around tariffs and material costs weighed heavily on sentiment. That concern has eased significantly.

Survey respondents now report:

- Greater stability in material pricing

- Reduced anxiety around tariff policy

- Improved confidence that construction costs will remain manageable

This improvement was one of the largest positive contributors to the overall sentiment index rebound.

Development Conditions Are Finally Improving

Developers reported a noticeably better outlook on:

- Local economic conditions

- Development approvals and entitlement processes

- Project feasibility as financing costs decline

For much of the past two years, projects simply didn’t pencil. As interest rate expectations ease and capital becomes more accessible, that bottleneck is beginning to clear.

Affordable Housing and Office Conversions

NAIOP continues to work with Congress and local governments on:

- Tax incentives for office-to-residential conversions

- Policies that reduce entitlement delays and regulatory costs

- Tools to increase affordable housing supply

Selvitelli emphasized that removing friction—whether through incentives or efficiency—can dramatically improve housing outcomes while strengthening municipal tax bases.

Most Active CRE Sectors Over the Next 12 Months

Survey respondents expect to be most active in:

- Industrial (still the top sector, though slightly down)

- Multifamily (notable increase in activity)

- Data Centers (significant spike in interest)

Retail and office activity followed closely behind, with several niche asset classes rounding out the list. Despite power availability and entitlement challenges, data centers remain one of the fastest-growing CRE segments.

Transaction Volume Expected to Rise

Looking ahead, respondents overwhelmingly expect transaction volume to increase over the next 12 months, driven by:

- Improved access to capital

- Lower interest rate expectations

- Declining cap rates that help bridge bid-ask spreads

As pricing clarity improves, deal flow is expected to accelerate.

Policy Certainty Reduces Risk

Another key sentiment driver is policy clarity at the federal level. Selvitelli highlighted that recent legislation addressed several critical CRE issues, including:

- Continued treatment of carried interest

- Preservation of Section 1031 like-kind exchanges

By removing major policy unknowns, the industry gains confidence to invest, transact, and develop.

About NAIOP and What’s Next

NAIOP represents 22,000 members across the U.S. and Canada and has been a leading CRE organization for nearly six decades.

Notably, beginning July 1 next year, NAIOP will officially become the Commercial Real Estate Development Association, reflecting its members’ growing involvement across:

- Industrial

- Office

- Multifamily

- Mixed-use

- Data centers and more

NAIOP’s flagship event, CRE.Converge, will take place in Denver in early October, with expanded content focused on capital markets, mixed-use development, and regional industrial growth.

Final Takeaway

The NAIOP CRE Sentiment Index 2025 delivers a clear message:

Commercial real estate is regaining its footing.

With reduced uncertainty, improving capital conditions, stabilizing fundamentals, and renewed development feasibility, the industry is positioning itself for growth heading into 2026.

As Selvitelli summed it up—when uncertainty fades, business tends to thrive.